Introduction

From April 2028, UK drivers of electric vehicles (EVs) will face a new 3p‑per‑mile tax, while plug‑in hybrids will pay 1.5p per mile. The measure, confirmed in the Autumn Budget, is designed to replace declining fuel duty revenues as more motorists switch to electric. Understandably, this announcement has raised concerns: will EVs still deliver real savings, or does this mark the end of their financial advantage?

The Cost Concerns

Critics argue the tax could double running costs for some EV owners. For example, a driver covering 5,500 miles annually on a cheap overnight tariff currently pays around £111 in electricity. With the new tax, that rises to £278 — an increase of £167 (Which?). High‑mileage drivers worry the savings they counted on may shrink, while sceptics see this as proof EVs aren’t as affordable as promised.

Where EVs Save You Money

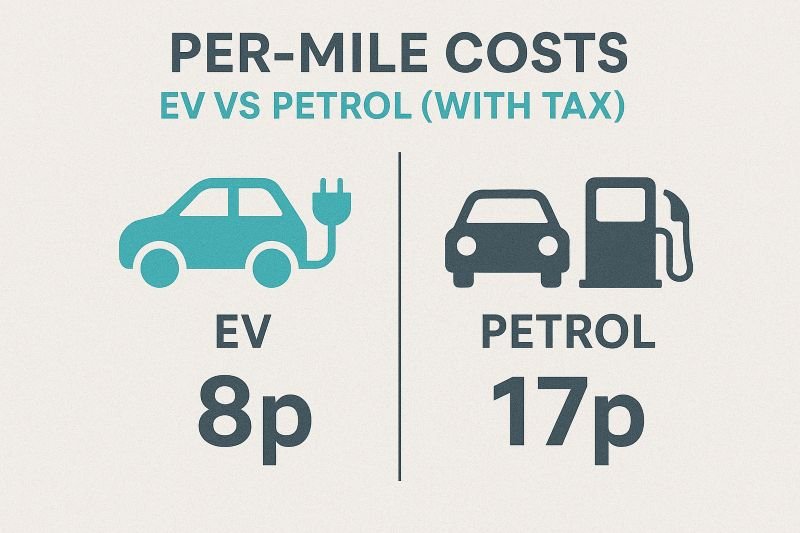

Even with the tax, EVs remain cheaper to run than petrol or diesel. A home‑charged EV averages 5–9p per mile including tax, compared to 12–18p per mile for petrol. Annual running costs in 2025 are roughly £1,735 for EVs versus £3,160 for petrol cars, saving drivers around £1,400 per year (The Complete Design Lab). Maintenance is also lower: fewer moving parts mean fewer repairs, and EVs still enjoy exemptions from London’s ULEZ and congestion charges, saving commuters £12–£20 daily (Transport for London).

Pros and Cons of EV Ownership

Pros:

- Lower annual running costs (fuel, tax, maintenance).

- Exemption from ULEZ and congestion charges.

- Cleaner air and quieter driving.

- Government grants (up to £3,750) still available for eligible models (UK Government EV Grants).

Cons:

- Higher upfront purchase price.

- Public charging can be costly (up to 70–90p/kWh).

- Depreciation remains steeper than petrol, though improving.

Busting the Myths

- Myth: EVs will be more expensive than petrol after the tax.

Reality: Even with eVED, EVs remain cheaper per mile when charged at home (Auto Express). - Myth: Mileage checks will invade privacy.

Reality: The system relies on MOT odometer readings, not GPS tracking (Electric Car Scheme). - Myth: EV incentives are ending.

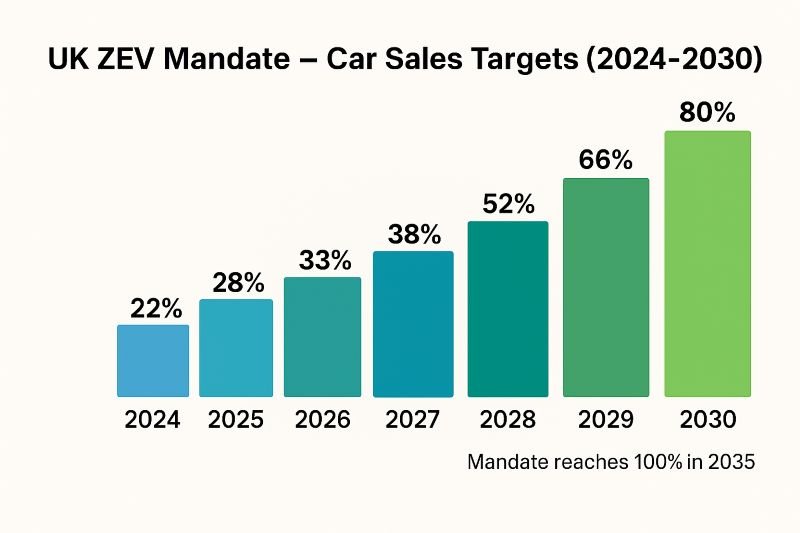

Reality: Grants and salary sacrifice schemes continue, offsetting costs. - Myth: EV adoption will collapse.

Reality: Over 1.75 million EVs are already on UK roads, with 22.7% of new car registrations in 2025 being electric (Zap‑Map).

A Real‑World Example

Take James, a commuter in Birmingham. He drives 9,000 miles a year in his Nissan Leaf. Today, his annual charging costs are about £540. With the new tax, they’ll rise to £810. But compared to his old petrol hatchback, which cost £1,650 in fuel alone, he’s still saving over £800 per year — plus lower servicing bills.

Industry Insights and Stats

- Average EV running cost: £1,735 per year vs £3,160 for petrol (The Complete Design Lab).

- EV adoption: 1.75 million fully electric cars on UK roads, 22.7% of new registrations in 2025 (Zap‑Map).

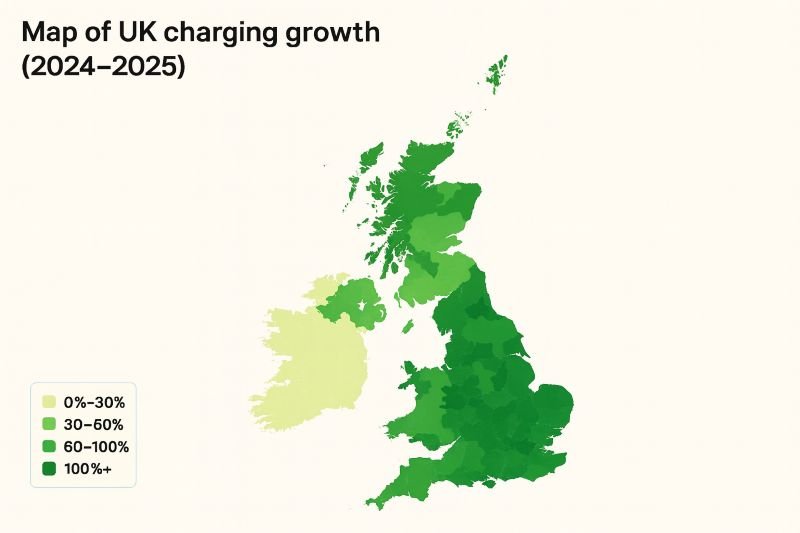

- Charging infrastructure: 86,021 public charge points as of October 2025, up 23% year‑on‑year (UK Government).

- Government revenue: The tax expected to raise £1.4bn annually by 2029–30 (Auto Express).

Looking Ahead

The pay‑per‑mile tax is part of a broader shift toward fairer road funding. While it narrows the gap between EVs and petrol cars, it doesn’t erase the financial edge. With charging infrastructure expanding and battery ranges improving, EVs remain the smarter long‑term choice. Policymakers will need to balance revenue needs with incentives to keep adoption on track.

Conclusion

Yes, the new tax adds cost. But EVs still deliver significant savings, especially for home chargers and city commuters. The fundamentals haven’t changed: lower fuel bills, cheaper maintenance, and cleaner air. For UK drivers, the question isn’t whether EVs save money — it’s how much, and how quickly those savings add up.